virginia ev tax incentives

The hybrid tax credit will not increase your refund because it is nonrefundable. And potentially even more importantly these tax credits will be refundable.

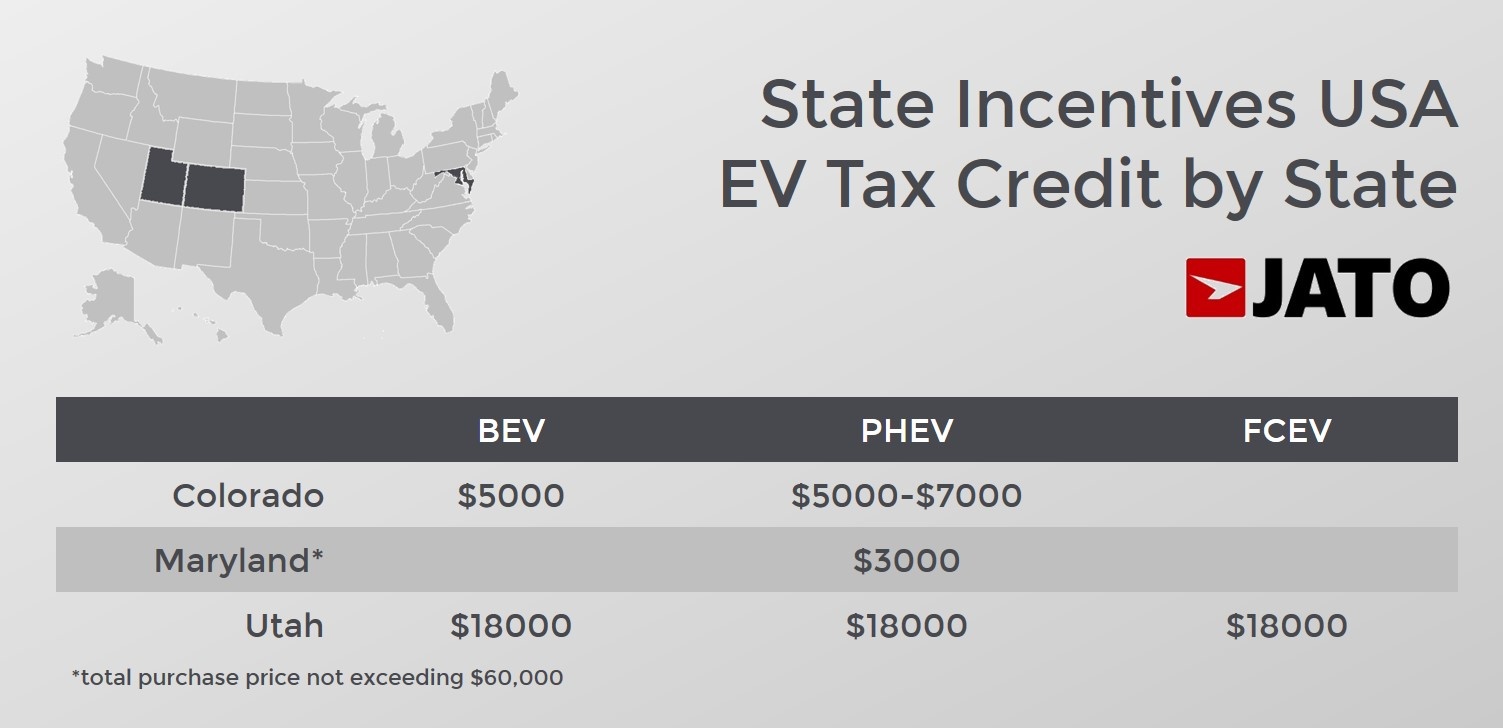

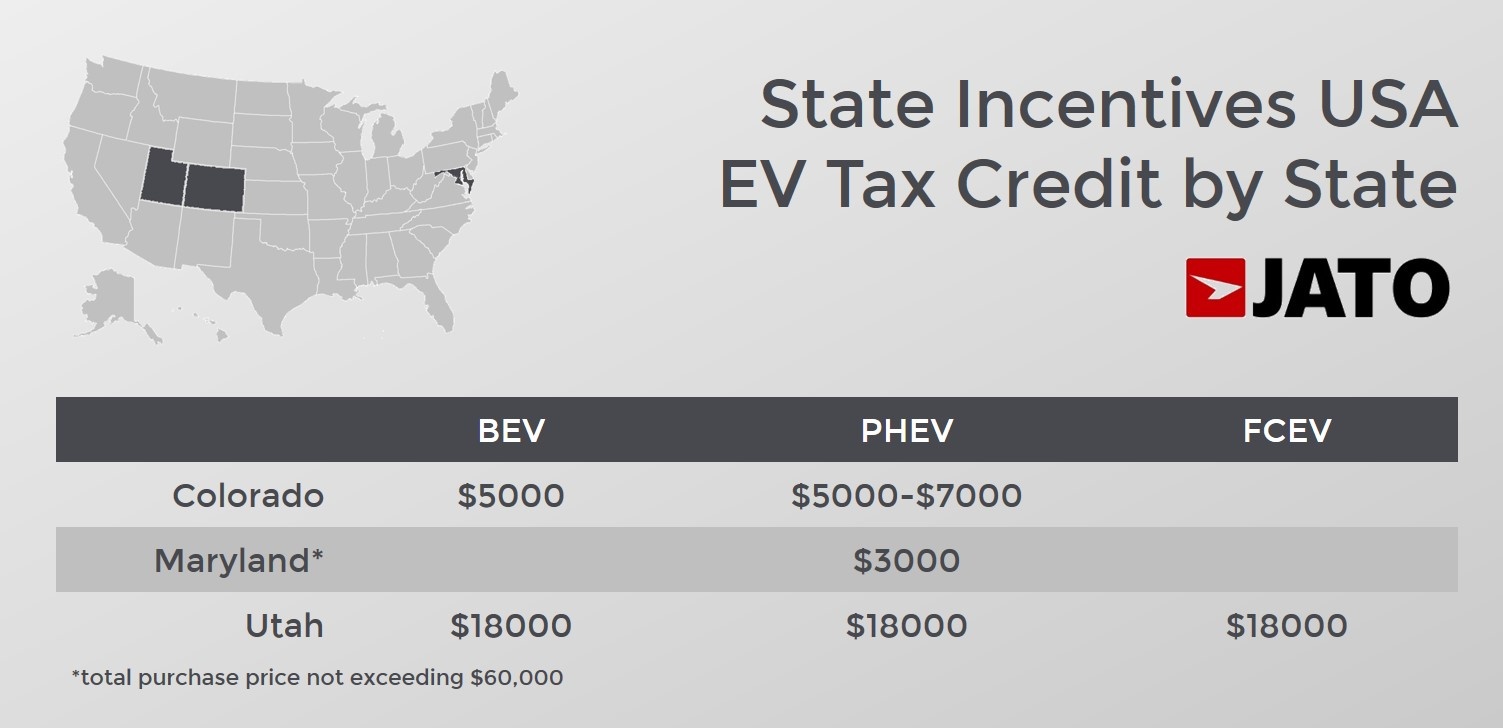

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Federal government also has credits and perks for you to take advantage of.

. Refer to Virginia Code 581-2250 for specifics. We will use the results of the pilot to evaluate future EV-related offerings for customers. Sarah VogelsongVirginia Mercury Don Hall has put his money on electric.

One benefit for you to reap is an income tax credit of up to 7500 2. The Commonwealth of Virginia provides several incentives for drivers of EVs to take advantage of. Specifically the Volkswagen ID4 which he bought this summer.

An enhanced rebate of 2000 would also be available to buyers whose household income is less than 300 percent of current poverty guidelines. All-electric vehicles EVs registered in Virginia are subject to a 8820 annual license tax at time of registration. This number varies depending on the capacity of the battery and the vehicles total weight so be sure to check with us to see.

This is in addition to the 7500 2 rebate that the federal government is presently granting buyers. If you live in either Arlington or Loudoun County you may qualify for reduced personal property tax. In addition to the West Virginia-specific incentives listed above there are several federal tax credits for fuel-efficient vehicle owners.

Enrollment is now closed but current participants may remain on the pricing plans. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. Federal Tax Credits for Fuel-Efficient Vehicle Owners.

The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits. The incentives may vary by sector but in general there are programs for all types. When an eligible Virginia resident purchases an electric or plug-in hybrid vehicle there is a 2500 1 tax incentive to collect.

Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. Special rate now available for Virginia EV owners. Compressed natural gas CNG.

Reference Virginia Code 581-2217 and 581-2249 Electric Vehicle EV Rebate Program Working Group. Additionally during off-peak hours you can take advantage of discounted electricity rates if youre charging your vehicle at home. Reid D-32nd would have granted a state-tax rebate of up to 3500.

Electric Vehicles Solar and Energy Storage. A buyer of a new electric car can receive a tax credit valued at between 2500 and 7500. Residential customers small and large businesses and government agencies.

If the purchaser of an EV has an income that doesnt exceed 300 percent of the federal poverty level they can get an extra 2000 on their rebate for a new EV purchase and an extra 500 for a used EV purchase. We launched the Electric Vehicle Pricing Plans Pilot Program to study the impacts of EV charging on the grid. Drive electric virginia is a project of.

For example you might qualify for tax credits offered by the IRS if you own. A purchaser or lessee of an electric vehicle would receive a 2500 rebate at the time of purchase and a purchaser or lessee with an annual 33. The Commonwealth of Virginia grants rebates.

1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle. For more information see the Virginia DMV Electric Vehicles website. Review the credits below to see what you may be able to deduct from the tax you owe.

Drive Electric Virginia is a project of. An electric vehicle charges at a public station in Henrico County July 2020. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

According to the white house eligible evs will need to be made in the us with union labor to qualify for the full 12500 credit. A bill proposed in mid-January by Virginia House Delegate David A. Local and Utility Incentives.

In Virginia the electric vehicle incentive via Appalachian Power can save you hundreds of dollars on your car costs and energy bill when you opt for off-peak charging. Virginia isnt the only entity that aims to incentivize the ownership of electric models. The pilot program began in 2011 and ended November 30 2018.

Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. The 30 increase in efficiency over building standards must be certified by a professional not related to the applicant. HB 1979 proposes that an individual who buys or leases a new or used electric motor vehicle from a dealer in Virginia and registers the vehicle in Virginia would be eligible for a 2500 rebate.

Roanoke offers a 10 real estate tax credit over five years for any homes that achieve a 30 increase in energy efficiency over Virginias Uniform Statewide Building Code standards. This list is organized by the category of incentive energy efficiency renewable energy and alternative fuels and vehicles and then by the organization offering the incentive. Any home in the City of Roanoke is eligible for the credit.

The Virginia General Assembly approved HB 1979 which provides a 2500 rebate for the purchase of a new or used electric vehicle. An additional 2000 rebate would be. In its final form the program which would begin Jan.

The president and CEO of the Virginia Automobile Dealers Association sparked surprise this winter when he threw his influential. The incentives go up as high as 12500 on new cars and up to 4000 on used electric vehicles. State Incentives Transit Emissions Reduction Grants Government Alternative Fuel Vehicle AFV Incentive Port Drayage Truck Replacement and Retrofit Incentive Biodiesel Production Tax Credit Agriculture and Forestry Biofuel Production Grants High Occupancy Vehicle HOV Lane Exemption Green Jobs Tax Credit Biofuel Feedstock Registration Exemption.

Additionally electric vehicles and all vehicles using clean alternative fuels are exempt from Virginias emissions inspection. What Qualifies as Clean Fuel in VA. Thanks to new technology competition and electric car tax credits EVs are more affordable than ever 32.

This tax credit will stay at 30 through 2019.

Affordable Solar Program Launched In Louisiana For Middle Class Homeowners Solar Program Solar Energy Solar Installation

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Eu Opposes U S Tax Credit Proposal For Evs Automotive News Europe

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Tesla Model S Is World S Leading Electric Vehicle Http Www Carengines Co Uk Blog Category Tesla Tesla Model S Tesla Motors Model S Tesla Model

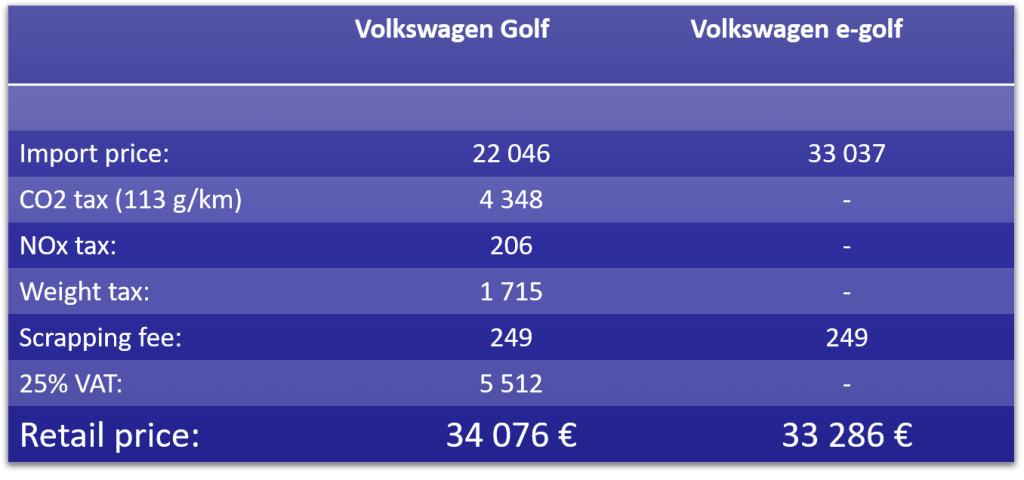

Norwegian Ev Policy Norsk Elbilforening

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Tesla Model 3 Elon Musk Unveils The Model 3 To Huge Fanfare Tesla Model Car Model 2018 Tesla Model 3

New 2015 Ford C Max For Sale Clearwater Fl Ford C Max Hybrid Car Ford Ford

Latest On Tesla Ev Tax Credit March 2022

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Key Senator Questions Need For Expanding U S Ev Tax Credit Reuters

How To Calculate The Federal Tax Credit For Electric Cars Greencars

Lthough Iroko Has Its Own Durability Coming From The Source Of The Nature Novawood Increases Its Perfection With Its Thermowood Process Ref Kaplanka Ic Mekan

Manchin S Electric Car Tax Credits Opposition Imperils Incentive As Prices Rise Bloomberg